TERMS & CONDITIONS

Quis eleifend quam adipiscing vitae proin sagittis. Adipiscing elit duis tristique nibh sit amet commodo nulla. Vitae semper quis lectus nulla. Pretium aenean pharetra magna ac placerat vestibulum lectus.

120.32 |+14% in 16 min

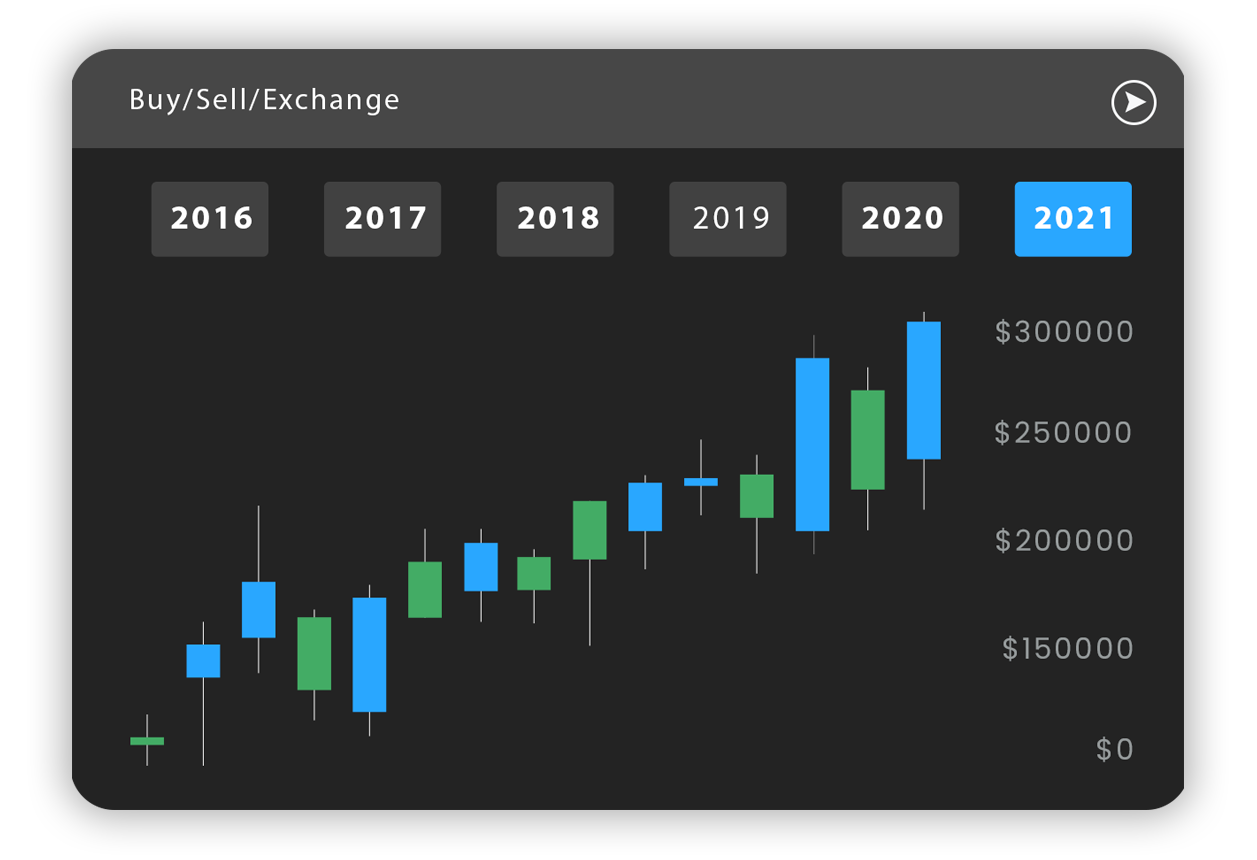

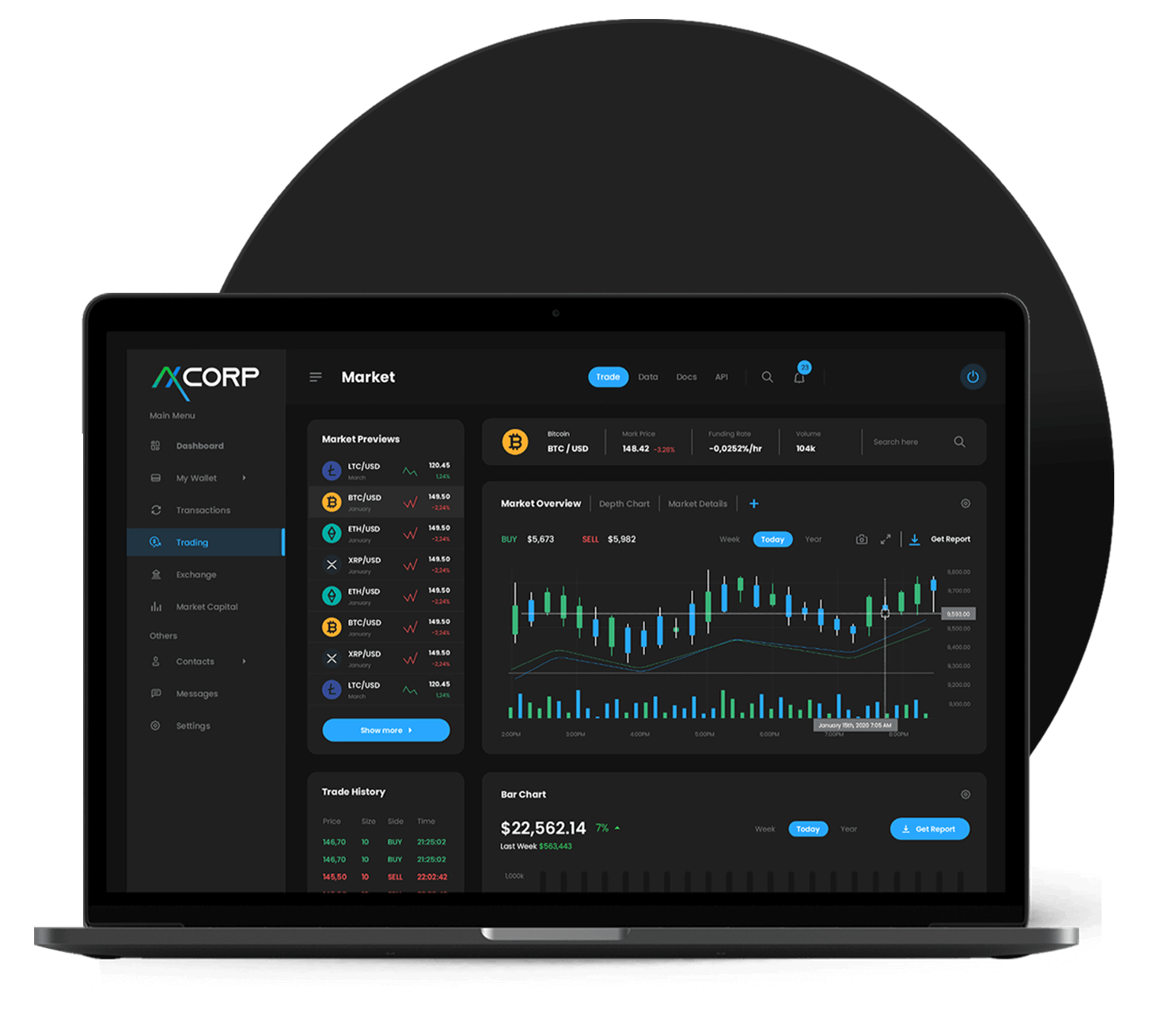

Fund your account and start trading on the world’s financial markets

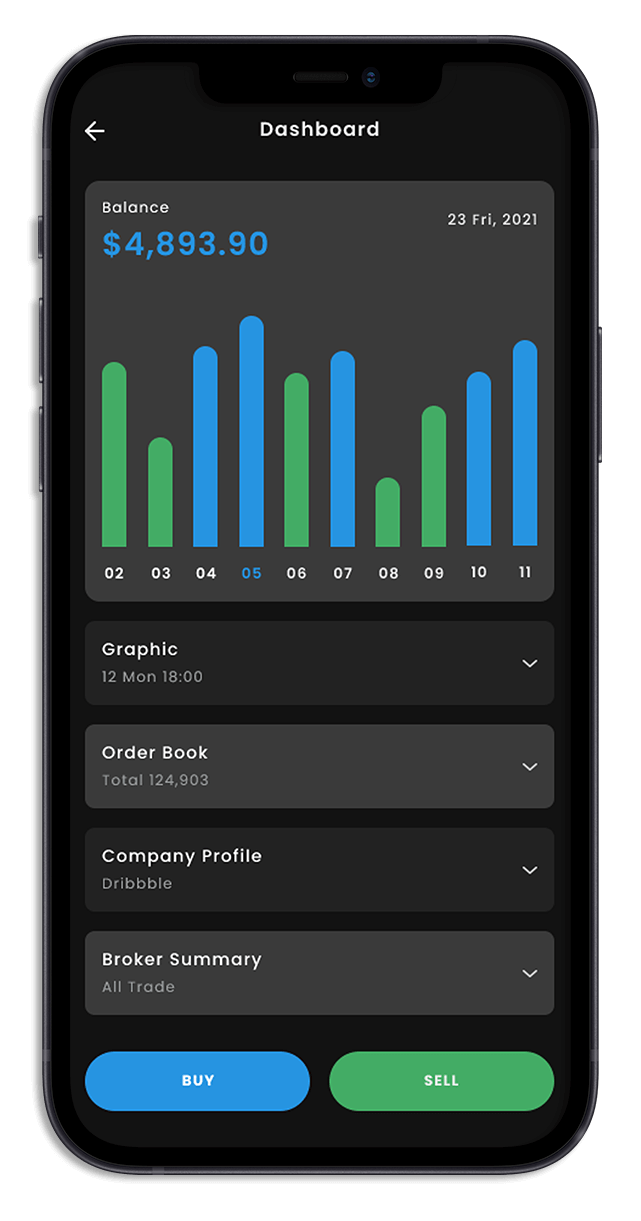

Trade using an advanced trading platform using web or mobile

Find yourself a suitable trading plan tailored to your needs

Tellus mauris a diam maecenas sed enim ut sem. Sem integer vitae justo magna. Orci eu lobortis elementum nibh mattis nunc sed blandit libero volutpat sed cras tellus at urna mattis pellentesque id nibh. Aliquet risus feugiat in ante metus at tempor ac felis donec et odio pellentesque.

Sem integer vitae justo magna. Orci eu lobortis elementum nibh mattis nunc sed blandit libero volutpat sed cras tellus at urna mattis pellentesque id nibh. Aliquet risus feugiat in ante metus at tempor ac felis donec et odio pellentesque.

The mobile version of the Meta Trader 4 application allows me to follow all the operations during my day easily and helps me to exit operations at the right time. Congratulations

We cannot accept traders from Cuba, Iran, Lebanon, Syria, North Korea, Libya, Sudan, Czech Republic or Somalia at this time due to U.S. Government restrictions and or risk management decisions.

As a result of regulatory determinations and business choices founded on risk assessment factors, Nova Funding has discontinued the onboarding of clients from India and Pakistan starting on August, 30 2023. Clients residing in India or Pakistan who have joined our platform before August 30, 2023 may continue to use our services, however new evaluation accounts can no longer be purchased from traders who reside in these countries.

Base leverage on all simulated accounts are set at 1:100 with FXCH, during the evaluation as well as the experienced trader stage.

Please have a close look at the contract sizing provided by the price provider before beginning the program, as different instruments will carry different levels of margin on all paper trading accounts.

Each trader is granted unlimited time to pass the evaluation. Once the 10% profit target is met, you can start the upgrade process into your “experienced trader” commission eligible paper trading account in as soon as 1 trading day. The evaluation phase lasts as long as your trading strategy permits.

The profit target during the 1-Step evaluation is a 10% gain from the starting balance of the account. For example, if the starting balance is $100,000, your profit target is $10,000. There is no profit target during the experienced trader stage.

All payouts are processed through Cryptocurrency.

When traders are eligible for commission payouts, they will have the option to receive performance commission payouts on either the BTC (Bitcoin Network) or USD-T (ERC-20 Network).

Payouts are reviewed and sent to the trader within 1-5 full business days of the request, please be mindful that weekends and U.S. holidays would not be a part of the processing time.

The technology provider we utilize for all simulated accounts on our platform is Foreign Exchange Clearing House LTD. FXCHL.

Nova Funding acts as the “evaluator” through a demo evaluation. Any simulated trading activity forgoing into the funded stage executed by a trader is provided through FXCHL, a 3rd party technology provider based in Eden Island, Seychelles while providing a trading experience in accordance with all Seychelles local laws and jurisdiction.

Once the necessary calendar days have passed for your payout schedule, you will see a button appear on your dashboard titled “Close Period”. Once this button is selected, your experienced trader account will go into review and you will receive a confirmation from us via email to confirm the commission payout.

If you run into any issues finding the payout button, you may also request a commission payout via live chat once you are eligible.

In order to find your trader agreement, navigate to the dashboard and select the “Phase 2 (Experienced Trader)” account which is titled as “Agreement Pending”. Once you click on this, you will be navigated to the next page with a button titled “Download PDF”. You may download and sign this document before submitting it to your dashboard.

Both the daily drawdown and total drawdown metrics are based off of account equity. This means that the 4% daily drawdown is not a static metric, but one that trails forward with the highest floating profit of the day.

For example, on a 100k simulated account, your equity based daily drawdown amount is 4% ($4,000).

If you have an open trade running with $1000 profit, but this same trade ends up being -$3000 in the negative, this would equal a 4% change in equity thus meeting the drawdown limit of the day which would cause a risk- limit breach.

Our drawdown parameters work differently than other firms, with the simple reason being that traders can pass with HFT. This means drawdown parameters will need to be slightly more difficult in order to mange risk from our side.

Equity based drawdown applies to all 1-step programs as these permit the use of HFT. On the contrary, we will introduce a new program variant soon which entails a balance based drawdown metric. The new program variant would not allow the use of HFT, which would be the distinguishing factor for being able to have balanced based drawdown features. You can find further explanations on our drawdown by viewing the detailed FAQ through the button below.

If the challenge stage is passed without the use of HFT/Latency arbitrage bots, there will be absolutely no-limit on the amount of virtual profit you can earn.

This is a category that we strive to be transparent on here at Nova Funding, and the short answer is no. Traditional prop firms within the forex industry operate under a different model than standard proprietary funding firms that you would typically encounter on Wall Street. Traders that sign up for traditional forex prop firms are not provided with real capital in their MT4/MT5 accounts.

When a trader reaches the “experienced trader” stage, they are trading a simulated/demo stage in which they are rewarded commissions for, in exchange for positive performance during this level of the program aligned with the program rules.

While performance commission is paid to a paper trader during the “experienced trader” stage, the trade data of experienced traders can be monetized and utilized for further benefit by copy trading the data into the firms very own fund. This allows the trader to provide an offering as a “data analyst” to the firm, allowing them to be eligible for commission payouts of 50%, 70%, or 80% while providing such services to us, the numbers will change based on the value of each traders trading data, determined by performance and regular commission payouts.

This trade data is sent off to our offshore entitybeing established (Nova Prop Ltd.), in which live trading can be legally conducted using advanced risk management techniques.

Our U.S entity Nova Trading Solutions LLC does not conduct live trading and is simply meant to be an “evaluator”, and opens the door to commission eligible paper trading accounts to traders providing simulated service as data analysts.

Market conditions are provided by a 3rd party price providerFXCH, in which traders can utilize to grow, learn, and earn commission based on their performance after passing the evaluation stage and leveling up to be an “experienced trader”.

Occasionally, we may refer to the “experienced trader” stage as “funded”. Please note that any reference to a “funded” stage is a funded paper trading account with simulated live conditions.

Forex prop firms are usually created under the basis of gamifying trading through a software which rewards traders under simulated market conditions, albeit a similar concept as the real market with amplified potential reward.

We cannot accept traders from Cuba, Iran, Lebanon, Syria, North Korea, Libya, Sudan, Czech Republic or Somalia at this time due to U.S. Government restrictions and or risk management decisions.

As a result of regulatory determinations and business choices founded on risk assessment factors, Nova Funding has discontinued the onboarding of clients from India and Pakistan starting on August, 30 2023. Clients residing in India or Pakistan who have joined our platform before August 30, 2023 may continue to use our services, however new evaluation accounts can no longer be purchased from traders who reside in these countries.

© X Funding Prop Firm. All Rights Reserved.

DISCLAIMER: All information available on our site is intended solely for study purposes related to trading financial markets. Accordingly, we do not offer financial, investment, tax, or brokerage advice. Trading in the forex market is a high-risk activity, past performance does not guarantee future results. Do not risk more than you can afford to lose. Purchases of evaluations should not be considered deposits. Information on this website is not intended for any use that would be contrary to any local law of regulation. X Funding is not a broker and any payments are considered admission fees to participate in our demo evaluation in which traders unlock the ability to be paid based on simulated trading performance. Any simulated trading activity is provided by a 3rd technology provider, Borctagon which based out of Eden Island, Seychelles and operates in accordance with all local laws and regulations. Borctagon does not engage in brokerage services or client account management and purely offers simulated paper trading accounts. X Funding is a registered entity in Chipre and is compliant with all necessary laws and regulations provided in accordance with local and federal jurisdictions while acting as an evaluator for traders.